CryptoSlate:加密貨幣世界的權威平台

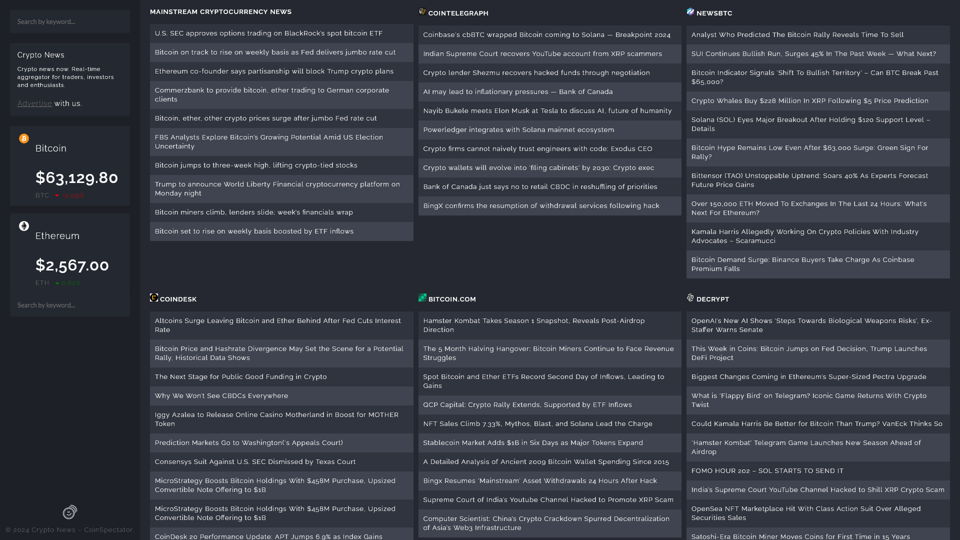

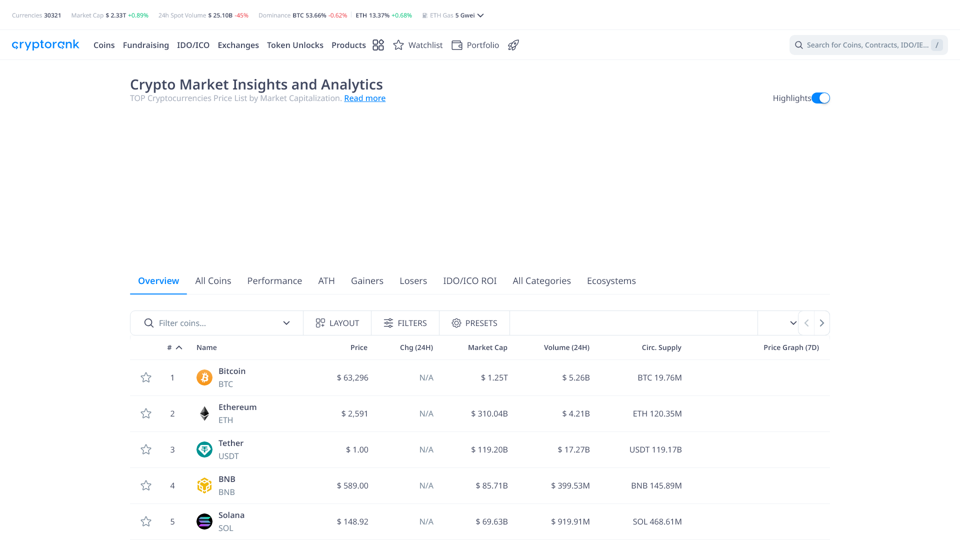

CryptoSlate 是一個領先的平台,旨在提供有關不斷變化的加密貨幣世界的全面見解和新聞。該平台專注於提供準確和及時的信息,為投資者、分析師和愛好者提供了寶貴的資源。CryptoSlate 聚合了最重要的新聞故事、深入分析以及有關各種加密貨幣的實時數據,確保用戶隨時瞭解市場趨勢和發展。

無論您是在尋求最新的比特幣、以太坊或新興小幣的更新,CryptoSlate 的廣泛報導和用戶友好的介面使您能輕鬆導航並獲取最重要的信息。此外,該平台還提供了教育資源,以增強用戶對區塊鏈技術及其對金融環境影響的理解。通過促進以加密意識為中心的社區,CryptoSlate 旨在使個人能夠在這個動態且有時不穩定的市場中做出明智的決策。加入一個不斷增長的加密愛好者和專業人士的網絡,通過 CryptoSlate 的可靠新聞和見解保持領先。