Paxumとは?

Paxumは、個人および企業向けにシームレスな金融取引を提供する革新的な決済ソリューションです。このプラットフォームにより、ユーザーは便利に送金・受取りを行い、世界中での送金ができ、プリペイドカードなどのさまざまな方法で資金に簡単にアクセスできます。Paxumは、使いやすい機能と競争力のある価格で決済体験を向上させることを目指しています。

Paxumの主な機能

- 多様な取引方法: ユーザーは、送金、EFT、ピアツーピア(P2P)送金を通じて支払いを行うことができ、さまざまなニーズに対応しています。

- Paxumプリペイドカード: プラットフォームはプリペイドマスターカードとユニオンペイカードを提供し、世界中のATM引き出しやオンライン購入を可能にします。

- ビジネスソリューション: Paxumは、大量支払い機能を提供し、企業が複数のクライアントやベンダーへの支払いを効率的に管理し、コストを削減できます。

- モバイルアクセス: Paxumのモバイルアプリにより、ユーザーは残高確認、取引の表示、資金の移動を外出先でも行えます。

- 迅速な事前承認: ユーザーは、アカウント作成プロセスが迅速であり、通常は24時間以内に事前承認を受けることができます。

Paxumの使い方

Paxumを使い始めるには、以下の簡単なステップに従ってください。

- アカウントを登録する: オンラインフォームに記入して、個人またはビジネスアカウントを作成します。

- 書類をアップロードする: 必要な身分証明書や確認書類を提出します。

- 取引を開始する: 承認されたら、支払いの送受信、資金へのアクセス、プラットフォーム上のすべての機能を利用できるようになります。

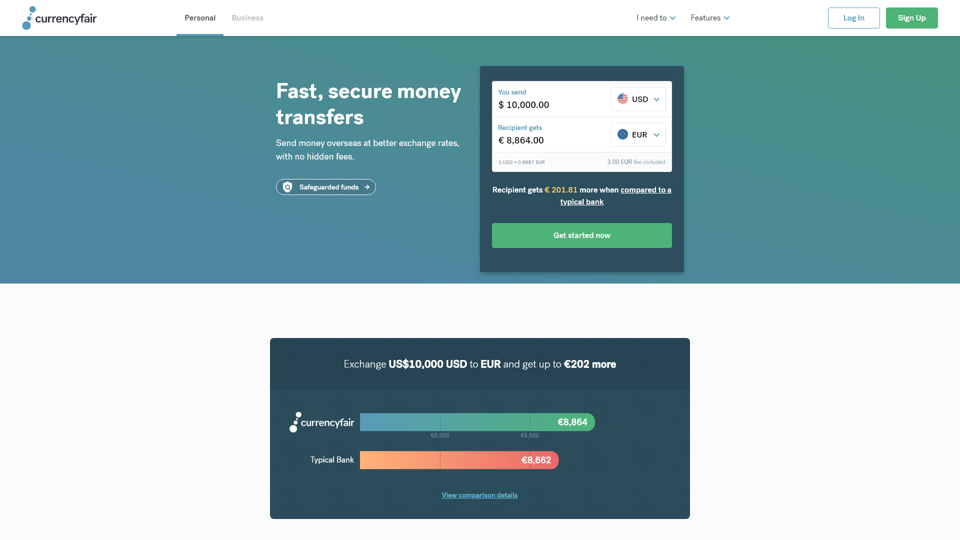

料金

Paxumは、個人およびビジネスアカウント向けに透明な価格構造を提供しています。ユーザーは、従来の銀行サービスに比べて比較的低料金の競争力のある手数料を享受できます。具体的な手数料の構造については、Paxumのウェブサイトの「料金」セクションを確認できます。

役立つヒント

- 適切なアカウントを選ぶ: 個人には日常取引に適した個人アカウントを、企業には大量支払いを利用するためのビジネスアカウントを選ぶべきです。

- モバイルアプリを活用する: モバイルアプリは便利さを向上させ、どこでもいつでも資金を管理できるようにします。

- 手数料を定期的に確認する: 定期的に手数料スケジュールをレビューし、Paxumを通じて取引の価値を最大化できるようにしましょう。

よくある質問

Paxumはどのような種類のアカウントを提供していますか?

Paxumは、個人ユーザーおよび法人クライアントのニーズに応じた個人アカウントとビジネスアカウントを提供しています。

Paxumアカウントから資金を引き出せますか?

はい、ユーザーはPaxumプリペイドカードを使用して資金を引き出すことができ、世界中のATMやオンラインまたは店頭での購入に使用できます。

Paxumは私の取引の安全性をどのように確保していますか?

Paxumは、先進的な暗号化および不正防止対策を講じており、安全な取引環境を提供することでユーザーの安全を最優先としています。

Paxumにモバイルアプリはありますか?

もちろんです!Paxumには、ユーザーが自分のアカウントを管理し、取引を確認し、資金を容易に移動できるモバイルアプリがあります。

Paxumアカウントを開くのにどれくらい時間がかかりますか?

ユーザーは、申請提出後約24時間以内にアカウントの事前承認を期待できます。

Paxumは、個人利用やビジネスニーズのために決済プロセスを効率化したい人にとって理想的なソリューションです。多様な機能やツールを活用することで、ユーザーは金融取引を効率的に管理できます。